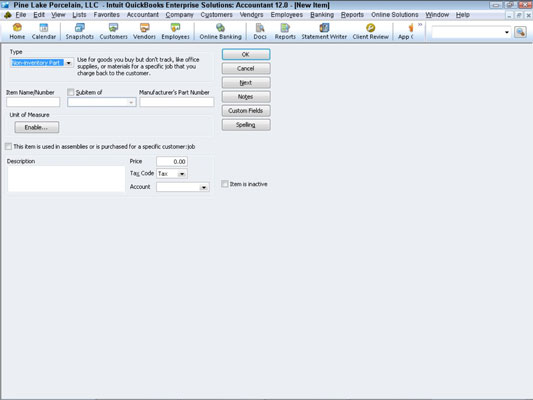

To add a non-inventory part — which is a tangible good that you sell but for which you don’t track inventory — display the New Item window and select Non-Inventory Part in the Type drop-down list. When QuickBooks 2012 displays the Non-Inventory Part version of the New Item window, give the non-inventory part a name or code by using the Item Name/Number box.

If the new item is a subitem, select the Subitem Of check box. Then identify the parent item by using the Subitem Of text box. Use the Description box to provide the description that should go on invoices that bill for this non-inventory part.

Obviously, you enter the price into the Price box. Use the Tax Code box to identify whether the item is subject to sales tax. Finally, use the Account drop-down list to identify the income account that should be credited for sales of this non-inventory part.

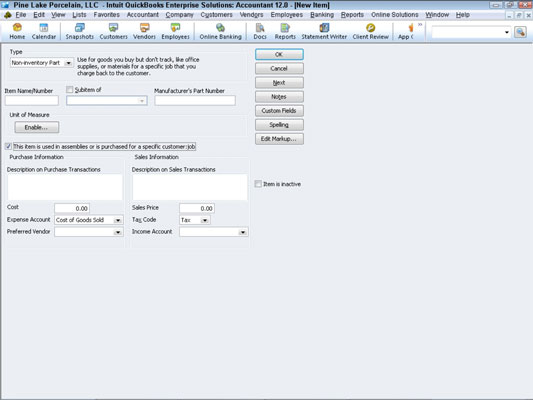

Note the check box labeled This Item Is Purchased for and Sold to a Specific Customer:Job. If you select that check box, QuickBooks displays a slightly different version of the Non-Inventory Part window.

This version of the Non-Inventory Part New Item window includes Purchase Information and Sales Information areas that work the same way as the Purchase Information and Sales Information areas supplied by the regular Inventory Part version of the New Item window.

dummies

Source:http://www.dummies.com/how-to/content/how-to-add-a-noninventory-part-to-the-item-list-in.html

No comments:

Post a Comment