If you’ve told QuickBooks 2012 that you want to create estimates — you do this during the QuickBooks setup — you can create job estimates of amounts you later invoice.

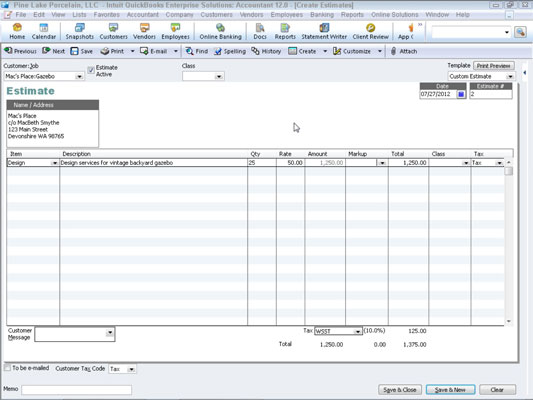

To create a job estimate, choose the Customers→Create Estimates command. QuickBooks displays the Create Estimates window. In a nutshell, you fill out the Create Estimates window the same way you fill out the Create Invoices window. This makes sense.

An estimate is just an example or guess at the future invoice for a job. Predictably, you collect and supply the same information, and you fill in the fields the same way.

Find the description of the related field on the Create Invoices window. Whatever you do with that field in the Create Invoices window is the same thing you do in the Create Estimates window.

When you invoice a customer for whom you have previously prepared an estimate, QuickBooks displays a list of the previously prepared estimates and lets you select one of these estimates as the starting point for an invoice. (This shortcut can be a real time-saver.)

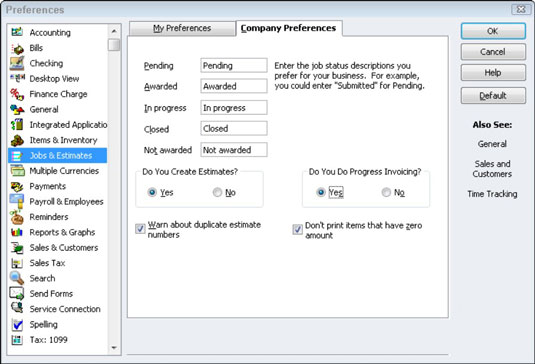

If you didn’t originally turn on Estimates when you set up QuickBooks, you can do so after the fact. Choose the Edit→Preferences command, click the Jobs & Estimates icon, click the Company Preferences tab, and then select the Yes radio button below Do You Create Estimates?. You may also want to select the Yes radio button below Do You Do Progress Invoicing?, if you do progress invoicing.

If you use estimates to create invoices, you actually create another way to track job costs. You can ask QuickBooks to prepare reports that compare, item by item, the estimated amounts for a job with the invoiced amounts for the job. To produce this report, you choose the Item Estimates vs. Actuals command from the Jobs, Time & Mileage submenu.

dummies

Source:http://www.dummies.com/how-to/content/how-to-use-job-estimates-in-quickbooks-2012.html

No comments:

Post a Comment