Quicken 2012 lets you record three common-to-tax-deferred-investment-account transactions by specifying several almost magical actions: shares out, stock split, and reminder transactions. You can tell Quicken to remove shares from an account — without moving the money represented by the shares — to some other account.

How to remove shares from an account in Quicken 2012

Why would you want to remove shares from an account using a shares-removed transaction?

You erroneously added shares to the account with the shares added transaction action and now you need to remove them.

You’re using an investment account to record old investment activity, such as activity from last year.

The first instance is self-explanatory because you’re simply correcting an error that you made. In the second case, however, you don’t want to transfer the proceeds of an investment sale to a cash account because the money from the sale was already recorded as a deposit at some point in the past.

You can record a shares-removed transaction directly into Quicken by clicking the Enter Transaction button and choosing Remove – Shares Removed in the Enter Transaction drop-down list box. Then fill in the rest of the fields in the dialog box the same way you would for a regular sell transaction. The only difference is that you won’t give a transfer account for the sale proceeds — because there aren’t any proceeds.

What to do in Quicken 2012 if stock splits and then doubles

Stock splits don’t occur very often; however, when they do occur, the company issuing the shares, in effect, gives you a certain number of new shares (such as two) for each old share you own.

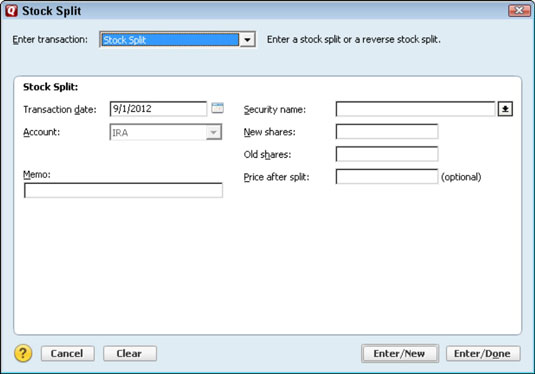

To record a stock split, you click the Enter Transactions button and select Stock Split in the Enter Transaction drop-down list box. When Quicken displays the Stock Split version of the dialog box used to enter investment transactions, you indicate the ratio of new shares to old shares.

For a two-for-one split, for example, you indicate that you get two new split shares for each old unsplit share. The whole process is pretty easy.

Reminder transactions in Quicken 2012

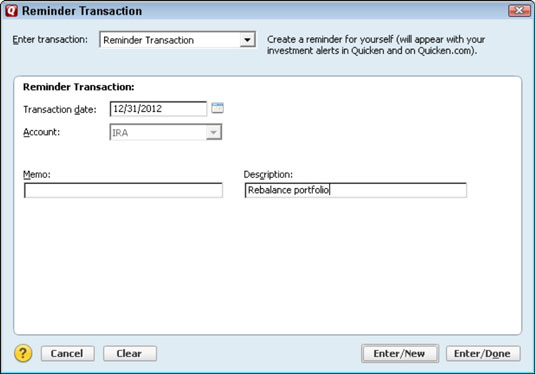

A reminder transaction is the electronic equivalent of a yellow stick-on note. If you put a reminder transaction in an investment account, Quicken gives you a reminder message on the reminder date. You can’t goof up anything by trying out reminders, so if you’re curious, enter a reminder transaction for tomorrow and see what happens.

You can post a reminder note by clicking the Enter Transaction button, selecting Reminder Transaction in the Enter Transaction drop-down list box, and filling in the dialog box that Quicken displays.

You might want to use reminder transactions to record due dates for contributions to retirement accounts or for required minimum distributions amounts or dates.

dummies

Source:http://www.dummies.com/how-to/content/how-to-work-with-tricky-investment-transactions-in.html

No comments:

Post a Comment